Medical And Health Insurance/Takaful

MHIT Made Simple – An initiative by FEN

What is medical and health insurance/takaful (MHIT)?

Cover medical expenses such as hospitalisation, medication, treatment, critical illness in the form of reimbursement, lump sum payment or hospitalisation allowance.

With MHIT, your medical cost will be covered up to a certain limit, protecting you from high and unexpected medical expenses.

Insurance premiums* collected will be pooled together in a common pool to pay for policyholders’ medical expenses.

Your premium may be reviewed annually based on individual risk profile such as age, medical history, occupational risk and lifestyle factors and to reflect changes in the cost of medical treatment. Higher risk policyholders pay relatively higher premiums to reflect the likelihood and severity of potential claims. Hence, your premium will increase as you age.

*Also refers to takaful contribution

Risk pooling:

Your premiums will be pooled with other policyholders’ funds to pay claims. If the total claims paid out from the pool of fund is higher than expected, the premiums for all policyholders may increase, even if you did not make a claim.

Premium Setting

Low risk:

RM200/month

Moderate risk:

RM250/month

High risk:

RM300/month

Risk Pooling

Total RM10,000 in risk pool based on initial expectation for RM9,000 claims cost and RM1,000 for other expenses

Claims Payment

Total claims payment from the pooled fund may exceed RM10,000

What should you do before buying MHIT products?

Introducing the ABC of buying MHIT products:

What should I consider before buying MHIT products?

Financial situation

- What is my budget?

- Will I be able to cope with the higher premiums over time?

- Do I have an existing MHIT protection from my employer?

Personal circumstances

- Do I have dependents who rely on me?

- What are the expenses that I will not be able to pay on my own, that will need to be covered by MHIT?

Medical history

- Do I have any pre-existing medical conditions?

- How about my family’s medical history?

What can I expect from my insurance/takaful agent?

Understand my situation, needs, and priorities before giving advice or recommending products

Explain in simple language the key factors affecting my insurance premiums such as medical inflation and age progression

Advise me to read and think about the information and explanations

Give me enough time to read and understand the information before making a purchase

What should I ask my insurance/takaful agent?

Is this the right MHIT product for me? Does it meet my needs?

- Types of MHIT products

- Key features such as coverage, claims process, limitations, etc.

How will my premiums change as I grow older?

- Age band premium increases

- Medical inflation

What else should I be aware of?

- Payment structure

- Waiting period

Get to know the 4 main types of MHIT products

Hospitalisation and surgical

Covers your medical expenses for hospitalisation or surgeries and specified outpatient treatments for covered conditions

Critical illness

Offers a specified lump sum benefit if you are diagnosed with any of the covered conditions. The covered conditions will differ for each product

Long-term care

Covers extended care benefits such as nursing home cost as well as care for chronic illnesses and disabilities

Hospital income

Pays a specified sum of money for each day that you are hospitalised for any covered illness, sickness or injury, up to a certain number of days

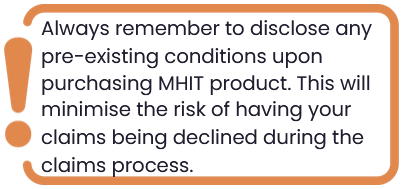

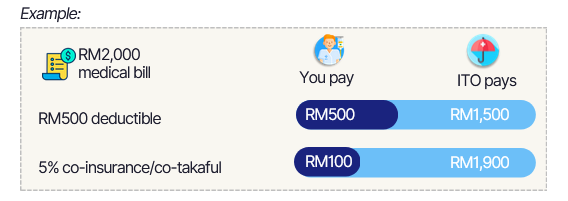

Heard of MHIT products with co-payment features?

Why opt for a co-payment feature?

- MHIT products with co-payment features have relatively lower premiums than comparable products without co-payment.

- Potentially less frequent and lower premiums adjustment in the long-term as it encourages more responsible consumption and prescription of healthcare services.

- The ITO may waive your portion of the co-payment under specified circumstances. Take note of these conditions as they are beneficial to you!

When purchasing MHIT product with co-payment features, it is important to consider whether you can afford the co-payment amount and whether you have alternative coverages such as employer insurance. Your choice should be guided by your financial situation and your capacity to meet these expenses.

Read and understand the product disclosure sheet (PDS)

When looking at MHIT products, it’s important to know exactly what you’re signing up for. The PDS is helpful because it gives you key information to help you choose the right MHIT products for your needs.

Remember, if you have any questions, don’t hesitate to ask your ITO or agent — they are there to help you understand the product better. Please request for the PDS. The PDS is a step-by-step guide that contains key information you should consider to help you make an informed decision. Please take time to go through the PDS and choose a product that best suits your needs.

Practical steps and tips to assist your decision-making process

Shop around! Compare different MHIT products

Consider the key features offered including coverage limits, benefits payable, renewability, exclusion and waiting periods.

Know the costs and choose wisely

Other than premiums, you will also have to pay for a portion of your bills if you opted for product with co-payment feature. When comparing products, it is important to consider whether you can afford the premiums and co-payment over the long-term.

Check the network of medical providers

Review the list of panel hospital and find out how to get a referral if needed.

Read the terms and conditions

Make sure to go over the terms and conditions carefully. Understand how long your policy lasts, what you need to do to renew it, and when it might be canceled or changed. Be sure to understand your coverage details and how ITOs evaluate claim eligibility, so you are fully informed about what to expect when filing a claim.

What information is included in the product disclosure sheet?

| Name | Product I | Product II | Product III |

|---|---|---|---|

| Annual Premium | RM2,400 | RM1,800 | RM2,000 |

| Payment type | Cashless facility | Cashless facility | Pay first, claim later |

| Coverage term | Until age 70 | Until age 70 | Until age 70 |

| Co-payment | No co-payment feature | RM500 deductible per policy/takaful year | 10% co-insurance/co-takaful per policy/takaful year |

| Hospital room and board limit | RM150 per day | RM200 per day | RM150 per day |

| Surgical expenses | As charged | ||

| Annual limit | RM100,000 | RM80,000 | RM100,000 |

| Lifetime limit | RM1,000,000 | RM800,000 | RM1,000,000 |

Note: This table only serves as a guide and does not capture all the features of the hospitalisation and surgical insurance/takaful products compared. Please ask your ITO or its agent for more information on the differences in features of products offered and refer to your policy/certificate contract.

What should you know about making claims?

D

Discover Your Claims journey

Claim with confidence

Falling sick is stressful enough – claiming your medical benefits should be simple and hassle-free. Take time to understand your coverage and claims processes early to avoid delays and get the right support when you need it most. Medical and health plans will help you pay for your medical bills but you may continue to bear part of the costs. This guide explains how to navigate your MHIT claims smoothly.

Check

Consider the key features in your policy including coverage limits, benefits payable, renewability, exclusion and waiting periods.

Check with your doctor, hospital, agent or ITO on whether the treatment plan, especially newer or uncommon treatment options are covered under your policy.

Clarify

Once your doctor has explained your treatment plan, take time to understand how you can pay for it. Clarify treatment options with your doctor if you expect difficulties paying for the treatment yourself. This helps you avoid financial surprises and choose the most suitable payment option for your situation – whether through personal health insurance, employer medical benefits or personal savings.

It is important to understand whether your policy comes with a cashless facility (ITO pay directly to hospital) or pay and claim (you pay first and ITO reimburse to you later). The payment method matters because it affects how much you need to prepare upfront to avoid financial surprises. If you are unsure, please contact your agent/ITO or ask the hospital admission counter.

Claim

The hospital will issue a bill for the total treatment cost, once your treatment is complete.

Keep in mind that this amount may include items that are not claimable under your policy. If your policy includes a co-payment feature, you will share a portion of the cost with your ITO. Co-payment applies regardless of the payment method.

Important

- Review your hospital bill carefully to make sure charges are itemised and appropriate. If your ITO has listed non-claimable items, you should not pay for those items unless they are for procedures or services that you had already agreed to.

- For pay first and claim later, please ensure the following:

- Check your ITO’s website or with your agent on documents you need to submit (itemised billing, supporting medical reports) and make sure you obtain complete documents from your hospital upon discharge

- Submit your claim as soon as possible

- Track your claims status

Know your rights and escalation options

If your claim is delayed, disputed or rejected:

- Ask your ITO or agent for clarification

- You or your agent can submit an appeal

- Make formal complaints with the Complaints Unit of your ITO

If you are not satisfied with their response or cannot resolve the issue with your ITO, you can contact the Financial Markets Ombudsman Service (FMOS) (https://www.fmos.org.my/en/our-scope/) or BNMLINK (https://bnm.gov.my/contact-us/BNMLINK)